Overview

Welcome to the definitive resource for leveraging ETL (Extract, Transform, and Load) tools to optimize your private equity data management. In the fast-paced world of private equity, the ability to seamlessly blend data from multiple sources into a coherent and central repository is invaluable. ETL not only facilitates this integration but also significantly reduces the risk of human error associated with manual data entry, especially when dealing with complex datasets intended for spreadsheet analysis. By automating the data handling process, ETL tools empower business users to perform sophisticated analyses with ease, using simple queries, visualization, charting, and tables, thus freeing up precious time for analysts to focus on more strategic tasks.

On this page, we will dive deep into the world of private equity data, providing a comprehensive understanding of what private equity data entails and the transformative impact ETL tools have on its management. We'll explore a variety of use cases that illustrate the efficacy of ETL in streamlining data processes in the private equity sector. For those seeking alternatives to traditional ETL approaches, we will introduce Sourcetable, a platform that offers innovative solutions for private equity data handling. Additionally, you'll find a detailed Q&A section addressing common inquiries about implementing ETL in the context of private equity data. Join us as we unravel the intricacies of ETL and its pivotal role in enhancing data strategy for private equity firms.

Understanding Private Equity Data

Private equity data encompasses both software tools and services that provide comprehensive insights and analytics for the private equity industry. These tools and services are designed to optimize processes, enhance data quality and reporting, and support decision-making in alternative investment strategies.

Software tools such as eFront's private equity software offer a suite of modular products that allow users to effectively track deal financial performance, manage deal expenses, make capital calls and drawdowns, and produce industry-standard reports. The inclusion of features like a general ledger, workflow tools for fund reporting, investor portals, data rooms, and interactive dashboards complement the robust data management and analytical capabilities of these platforms.

On the service side, private equity and venture capital data providers deliver APIs and datasets that enable alternative investors to filter private companies by various criteria, including location, company stage, and funding raised. These services are crucial for identifying high-growth deals, maximizing returns, and developing risk-managed exit strategies. Prominent data providers in the industry include Private Equity International, CEPRES, and PitchBook, which are based in the UK, Germany, and the US respectively.

ETL Tools for Private Equity Data

ETL, which stands for Extract, Transform, and Load, is a vital type of data integration used extensively within the realm of private equity. This process entails blending data from disparate sources to create a unified and consistent dataset. In particular, ETL is frequently employed in the construction of data warehouses, which serve as centralized repositories of integrated data.

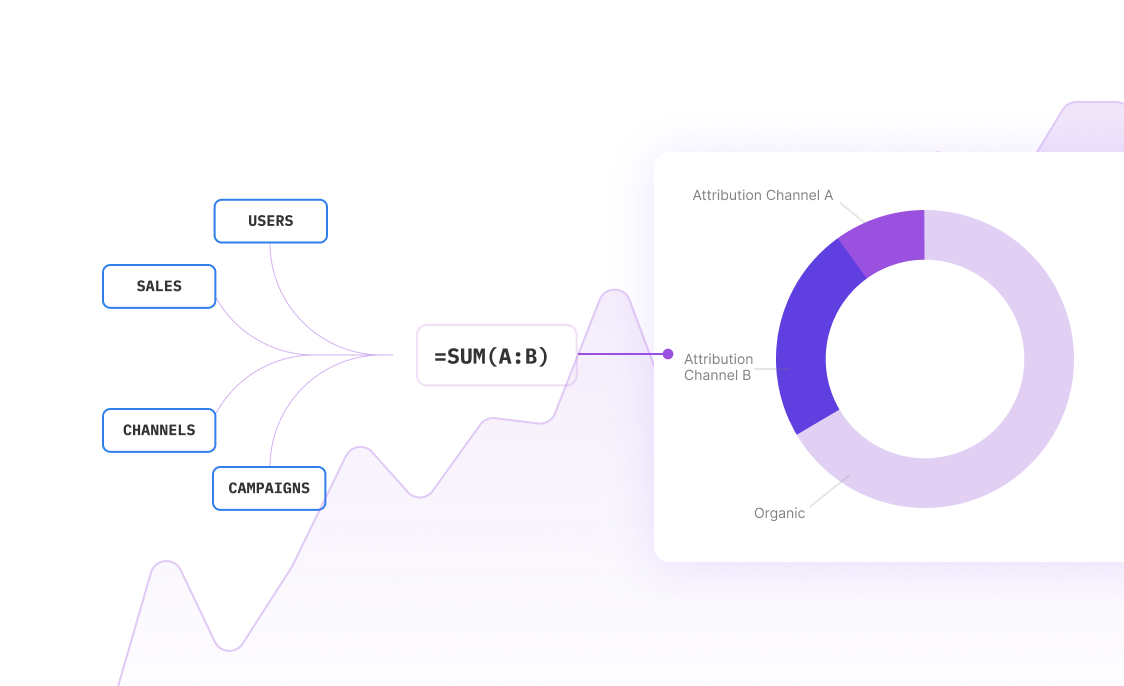

The ETL process plays a crucial role in mitigating the risk of errors that can arise from manual data entry. It provides a systematic approach to data handling, enhancing data integrity and reliability. Moreover, ETL empowers business users to access and analyze the data through straightforward queries, visualization tools, and various other analytical forms, facilitating informed decision-making.

Given the importance of ETL in managing private equity data, several tools have been developed to optimize this process. These tools vary in their capabilities and are designed to meet the diverse needs of financial institutions. They can handle tasks ranging from the management of high-volume, real-time data streams—essential for tracking stock prices or monitoring equipment performance—to providing powerful data quality and transformation tools for large enterprises.

Streamline Your Private Equity Data Management with Sourcetable

When managing private equity data, the traditional ETL (extract-transform-load) process can be cumbersome and time-intensive, especially when dealing with multiple data sources. Sourcetable offers a powerful alternative that streamlines this process by syncing live data from a wide array of apps or databases into one cohesive, spreadsheet-like interface. This eliminates the need for third-party ETL tools or the development of a custom ETL solution, saving significant time and resources.

Using Sourcetable for your ETL needs means that you can easily automate the integration of your private equity data, reducing the risk of human error and ensuring that your data is always up-to-date. The familiar spreadsheet format provided by Sourcetable enhances accessibility and allows for seamless querying and manipulation of data, which is essential for effective business intelligence. This user-friendly approach to data management empowers you to make faster, more informed decisions without the steep learning curve associated with traditional ETL tools or bespoke solutions.

Common Use Cases

-

Automating the collection and centralization of portfolio company reports, fund, and accounting data for analysis in a spreadsheetP

-

Converting various data formats from multiple sources into a unified format for spreadsheet useP

-

Improving data quality and automating compliance with regulatory reporting requirements through spreadsheet templatesP

-

Enabling business users to access and analyze private equity data through simple queries and visualization tools within a spreadsheetP

Frequently Asked Questions

What are the most common transformations in ETL processes for private equity data?

The most common transformations include data conversion, aggregation, deduplication, filtering, cleaning, formatting, merging/joining, calculating new fields, sorting, pivoting, lookup operations, and data validation.

What is the purpose of a staging area in ETL processes?

A staging area serves as intermediate storage to compare the original input with the outcome for auditing, store extracted data for recovery, and avoid the need to completely rerun a process that fails at a late stage.

Why are third-party ETL tools preferred over SQL scripts?

Third-party ETL tools are faster and easier to develop, automatically generate metadata, have predefined connectors for most sources, and enhance performance by allowing data filtering before joining.

How important is data profiling in an ETL process?

Data profiling is crucial for maintaining data quality as it checks for issues with keys, unique identification, data types, and data relationships.

Why is row versioning important in ETL processes?

Row versioning is necessary to maintain a history of rows and can be implemented by inserting a new record, using additional columns, or employing a history table.

Conclusion

ETL tools are indispensable in the realm of private equity, as they automate data pipelines, swiftly process vast amounts of structured and unstructured data, and enhance data accessibility, allowing firms to aggregate and deliver actionable insights efficiently. With the ability to minimize human errors, comply with regulatory demands, and foster investor trust through enhanced transparency, ETL solutions like Informatica PowerCenter, Apache Airflow, and AWS Glue, among others, empower firms to make informed decisions. However, for those seeking to streamline their ETL processes into spreadsheets with a user-friendly interface, Sourcetable offers a robust alternative. Sign up for Sourcetable today to transform how you handle ETL and leverage your data for maximum impact.