PMT

Formulas / PMTTo calculate periodic loan payments.

PMT(rate, nper, pv, fv, type)

- rate - interest rate of the loan

- nper - total number of loan payments

- pv - present value or principal (current total worth of a series of future payments)

- fv - future value (cash balance at the end of the last payment)

- type - 0 to indicate payments are due immediately, 1 to indicate payments are due at the end of the period, 0 by default

Examples

=PMT(A2/12,A3,A4)This PMT function can be used to calculate monthly loan payments with terms given by arguments from A2:A4.

=PMT(A2/12,A3,A4,,1)If you need to calculate monthly loan payments with terms given by arguments from A2:A4 but with payments due at the beginning of the period, you can use the above formula.

Summary

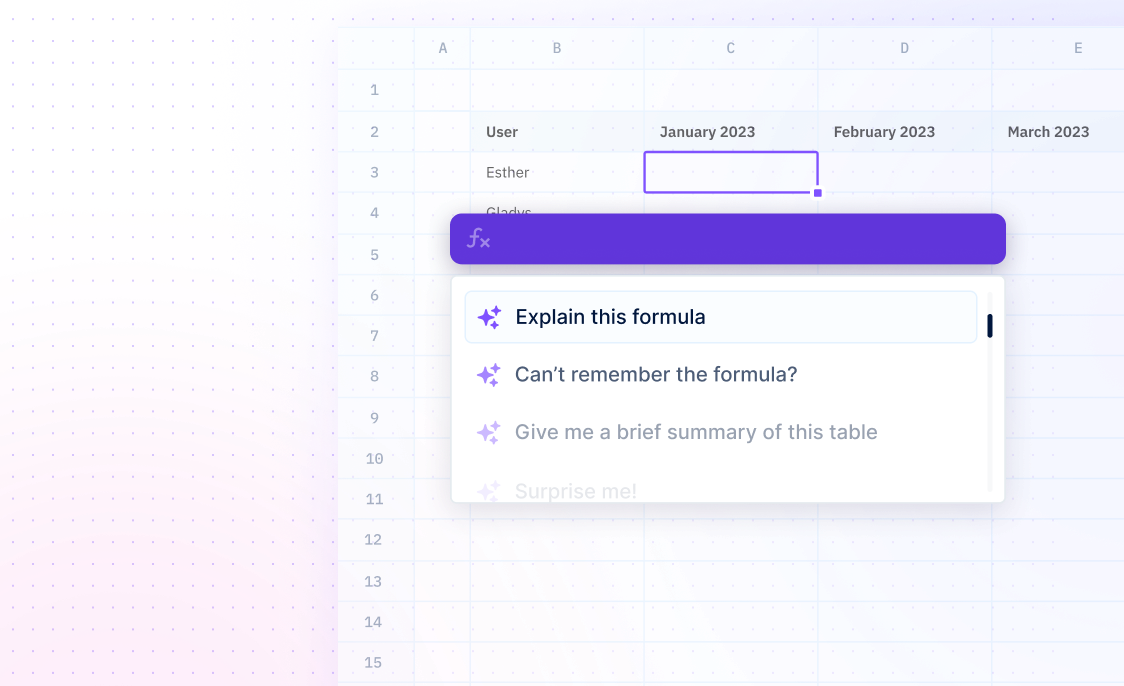

The PMT function is a Sourcetable function for calculating loan payments. It works by using constant payments and a constant interest rate to determine the payment amount.

- The PMT function determines payments for a loan, assuming both constant payments and a constant interest rate.

- Note that the PMT function doesn't include taxes, reserve payments, or fees.

- Be careful with units when using PMT. Make sure to use consistent units!

Frequently Asked Questions

What is the PMT function?

The PMT function calculates payments for a loan.

What type of payments does the PMT function use?

The PMT function uses constant payments.

What type of interest rate does the PMT function use?

The PMT function uses a constant interest rate.

What does the PMT return?

The PMT returns a payment that include principal and interest but excludes taxes, fees, and reserve payments.